When your new parts website goes Live, shipping rates should already be implemented. These are determined on the parts total of your customer's basket. If there are any items (ex: rotors, body panels) with fixed shipping costs assigned to them, then the basic rate will not be applicable to these items. However, should a cart or basket contain items with fixed shipping cost and without, both rates will be combined.

A basic shipping rate tier system might look like this:

You can edit these shipping tiers however you like as long as your Low and High columns do not overlap. Notice how the Low to High tier $0.00 - 20.00 increases to a $20.01 - 50.00 on the next tier. These tiers do not overlap and will function properly.

To edit your shipping tiers:

Go to Settings > Shipping Rates.

Click Edit on respective tiers or add new tiers.

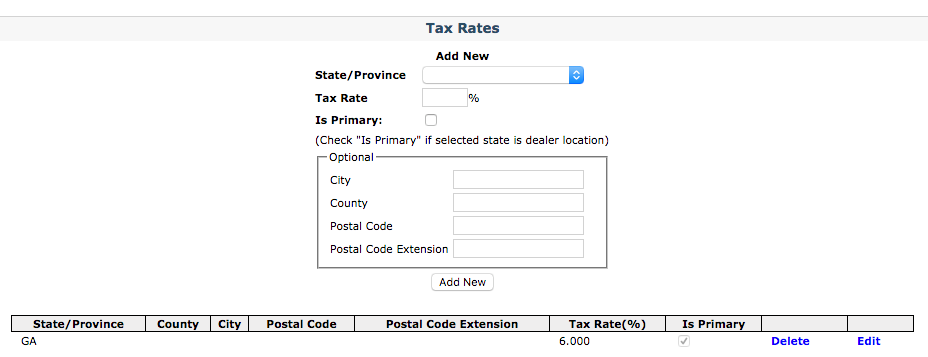

You can also easily add tax rates in the Control Panel:

Go to Settings > Tax Rates.

Add new Tax Rate State / Province, Tax Rate %, and check Is Primary.

Click Add New.

The first thing you should notice is your State or Province tax rate will populate on the lower half of the screen. From here, you have the ability to edit or delete.

Your state tax will populate for customers within your state. You can add additional states as required, but only one state may be selected as the Primary. In many cases, if a customer is purchasing from outside of your state, you are not required to collect sales tax. As of 2020, however, many states have set up new tax laws that require businesses to collect sales tax no matter where the business is located. It’s important to confirm with your accounting office in regards to your state's specific tax requirements and exemptions for e-Commerce sales.

Tip: Not seeing any settings? Make sure to select your website in the drop down menu located at the top right of your Control Panel.

Fixed Shipping Costs on Parts:

There are some products in your EPC, essentially your online catalog, which will require a fixed shipping cost. This will be displayed separately from the standard shipping rate during a customer's checkout process. It is also displayed with the item in your EPC or on the Product Detail page in your Control Panel. Fixed shipping is an additional cost intended for items considered overweight or over-sized which usually require additional freight and shipping charges.

Fixed shipping costs may include, but are not limited to, the following part categories:

| Chassis | Body | Drivetrain | ||

|

|

|

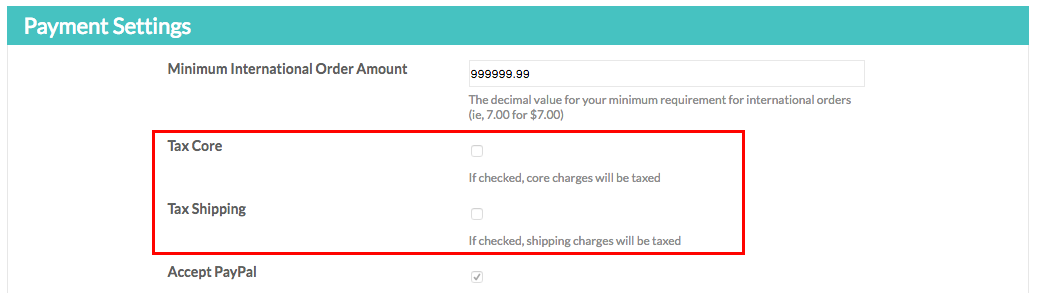

Taxing Core and Shipping:

In some cases, your dealership will be required to tax Core and Shipping. This will largely depend on state law. To apply your primary state sales tax to Core and Shipping:

Go to Settings > Setup.

Scroll down to Payment Settings.

Check the box for Tax Core and/or Tax Shipping, whichever is applicable.

Local Pickup:

You have the option of providing a Local or In-Store Pickup option during checkout. If the customer selects Local Pickup, shipping will not be applied to their final invoice. This handy feature can be turned on or off in the Control Panel.

Go to Settings > Payment Settings

Check Allow Local Pickup if you would like it turned on, or un-check the box to turn off.

If you choose to turn this feature on, this is what the customer will see during the checkout process.

ShipStation Integration:

You have the ability to integrate your SimplePart Control Panel with a service called ShipStation. This allows you to conveniently see your recent orders, take action on pending orders, ship orders, and create labels.

If you'd like to set up a ShipStation account, contact SimplePart Support at 404-520-7640 or support@simplepart.com